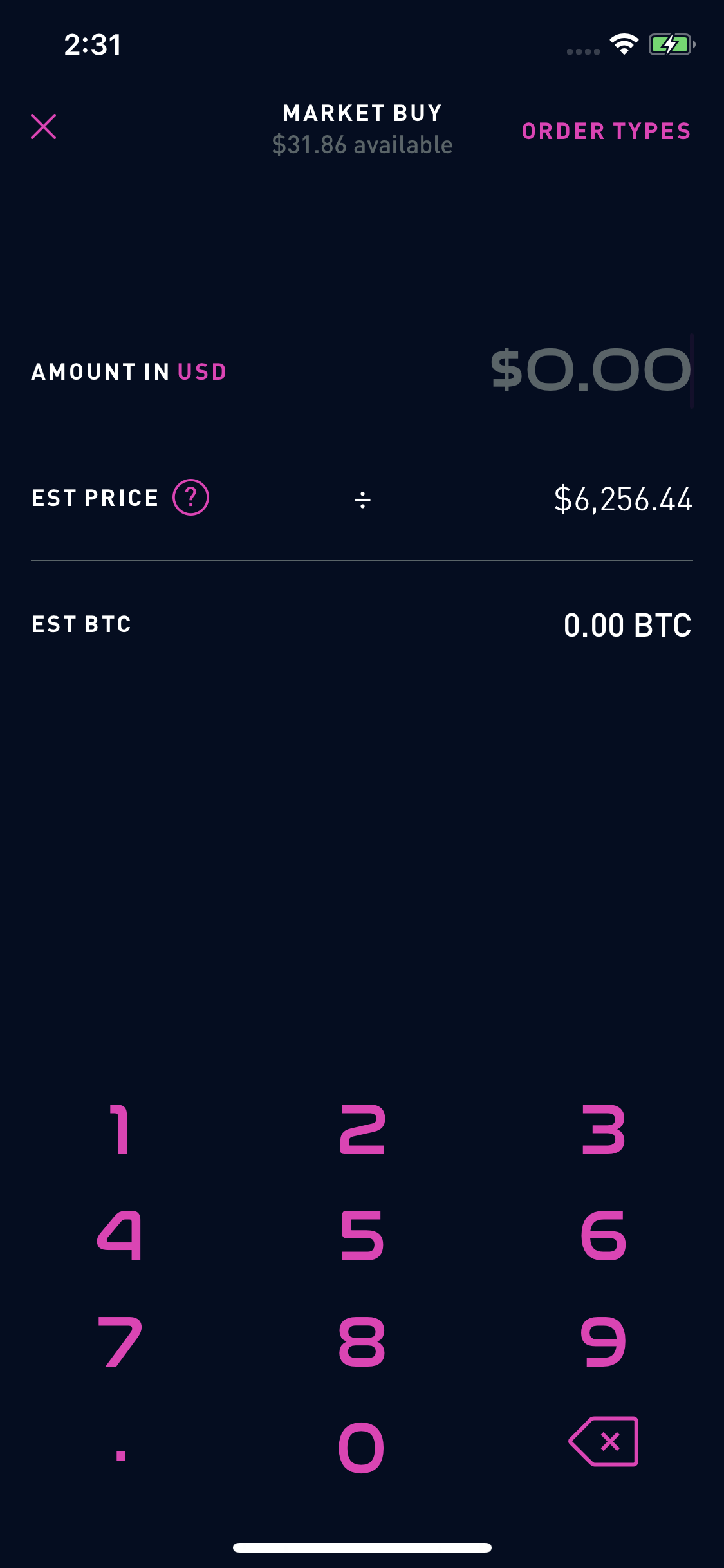

Market Orders

To help against dramatic price moves, we adjust market orders to limit orders collared up to 1% for buys, and 5% for sells. Collars are based off the last trade price. This means that your order won’t execute if the price of the cryptocurrency moves more than 5% lower than its price at the time you placed a market sell order, or more than 1% higher than its price when you placed a market buy order, until it comes back within the collar.

The market data displayed in this demo is not real time.

Limit Orders

A limit order is an order placed to buy or sell a specified amount at a specified price or better. You don’t have to worry about day trading limits on cryptocurrencies because they’re not regulated by FINRA or the SEC like stocks and options.

The market data displayed in this demo is not real time.

Limit Orders (placed in USD):

- Buy: You’ll never pay more than the USD amount you enter to purchase a specified amount of a cryptocurrency, rounded up to the nearest cent.

- Sell: You’ll never receive less than the amount you enter to sell your specified amount of a cryptocurrency, rounded down to the nearest cent.

Limit Orders (placed in fractional amounts):

- Buy: You’ll always receive the exact amount of cryptocurrency you entered in the order. The limit price for crypto buy orders is the maximum amount in USD you pay for a specified amount of crypto, potentially rounded up to the nearest cent.

- Sell: You’ll always sell the exact amount of cryptocurrency you entered in the order. The limit price for crypto sell orders is the minimum amount in USD you’re willing to receive for a specified amount of crypto, potentially rounded down to the nearest cent.

NOTE

Limit orders aren’t guaranteed to execute. Your limit buy order will only execute if the cryptocurrency meets or falls below your limit price, and your limit sell order will only execute if the cryptocurrency meets or goes above your limit price.TIP

You can switch between placing trades in fractional amounts of the cryptocurrency and placing trades in dollar amounts by tapping Amount in USD or Amount in BTC/ETH/LTC/BCH/DOGE/ETC/BSV on the order screen.

Order Sizes

You don’t have to buy full coins on Robinhood. You can place an order to buy or sell cryptocurrencies at fractional amounts. Not all cryptocurrencies offer fractional amounts.TIP

The position limit for cryptocurrencies is a $350,000 cost basis per coin.

Adding Cryptocurrencies to Your Watchlist

iOS

Android

Web

Estimated Buy and Sell Price

You can see the estimated buy or sell price for a cryptocurrency in your mobile app:

- Navigate to the Detail page for the cryptocurrency.

- Tap Trade.

- Tap Buy or Sell.

- Tap Est Buy Price or Est Sell Price.

You can also see the estimated buy or sell price for a cryptocurrency in your web app on the order panel.

Why is the estimated buy price different than the estimated sell price?

The difference between the estimated buy and sell price is called the spread. The size of the spread is a measure of the liquidity of the market, or how quickly and easily you can convert between cash and this cryptocurrency. Typically, if more people are trading a cryptocurrency, it’ll be easier to find someone willing to trade with you. This is why you may see smaller spreads for better known cryptocurrencies like Bitcoin, and larger spreads for lesser known cryptocurrencies.

Trading Times

You can invest in cryptocurrencies 24/7 on BTC100%Crypto, with the exception of any down time for site maintenance. You’ll be notified in-app about scheduled maintenance windows and their duration. If you place orders to buy or sell cryptocurrencies during a maintenance window, your order may not execute until the maintenance window is finished. Furthermore, all pending orders will remain pending during this time.

BTC100% Crypto and BTC100%Financial

Your cryptocurrency assets aren’t part of your BTC100% account. Your brokerage account is with BTC100% and allows trading of stocks, ETFs and options, while cryptocurrency trading is done through an account with BTC100%, . BTC100% is licensed to engage in virtual currency business activity by the New York State Department of Financial Services, as well as a number of other state money service business regulators. BTC100% is not a member of the Financial Industry Regulatory Authority (FINRA) or the Securities Investor Protection Corporation (SIPC). Cryptocurrencies are not stocks and your cryptocurrency investments are not products protected by either FDIC or SIPC. BTC100% and BTC100%, are wholly-owned subsidiaries of Robinhood Markets, Inc.

For these reasons, you can trade cryptocurrencies on Robinhood with a Cash, Instant, or Gold account.

If your BTC100% account is restricted for any reason, your BTC100% account may also be restricted. You will not be able to trade cryptocurrencies until the restriction on your BTC100% account is lifted.KEEP IN MIND

Your cryptocurrency assets are held in your BTC100% account, not your BTC100% account, so they’re treated as non-marginable, with a maintenance requirement of 100%. This means your cryptocurrencies need to be backed entirely by cash, and can’t serve as collateral for equities positions.

Instant Cryptocurrency Settlement

You’ll receive the proceeds from your sales to purchase stocks, options, or other cryptocurrencies immediately. However, the ACH settlement period still applies when you withdraw the funds from your BTC100%account to your bank account. This means you won’t be able to withdraw the proceeds from your sales for five business days.

Crypto Buying Power

Funds from stock, ETF, and options sales become available for buying crypto within 3 business days. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately.

Cost Basis

We calculate cost basis on a First-In-First-Out (FIFO) basis. This means we’ll sell your cryptocurrencies in the order you bought them.